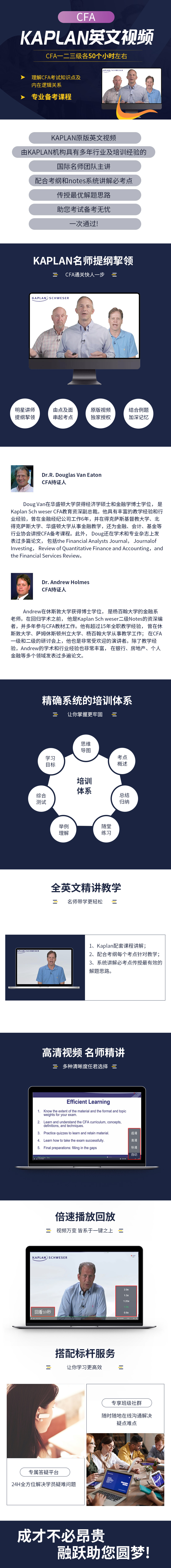

价格: ¥ 999.00

视频有效期:2026-01-01

视频时长:约143小时

详情介绍

课程大纲

{in name="user_id" value="21644"} {/ in}课程试听 推荐

1.Quantitative Methods(双语字幕)

Interest Rates and Return Measurement

![]()

Time-Weighted and Money-Weighted Returns

![]()

Common Measures of Return

![]()

Discounted Cash Flow Valuation

![]()

Implied Returns and Cash Flow Additivity

![]()

Central Tendency and Dispersion

![]()

Skewness Kurtosis and Correlation

![]()

Probability Models Expected Values and Bayes Formula

![]()

Probability Models for Portfolio Return and Risk

![]()

Lognormal Distributions and Simulation Techniques

![]()

Sampling Techniques and the Central Limit Theore

![]()

Hypothesis Testing Basics

![]()

Types of Hypothesis Tests

![]()

Tests for Independence

![]()

Linear Regression Basics

![]()

Analysis of Variance ANOVA and Goodness of Fit

![]()

Predicted Values and Functional Forms of Regression

![]()

Introduction to Fintech

![]()

2.Economics(双语字幕)

Breakeven, Shutdown, and Scale

![]()

Characteristics of Market Structures

![]()

Identifying Market Structures

![]()

Business Cycles

![]()

Fiscal Policy Objectives

![]()

Fiscal Policy Tools and Implementation

![]()

Central Bank Objectives and Tools

![]()

Monetary Policy Effects and Limitations

![]()

Geopolitics

![]()

International Trade

![]()

The Foreign Exchange Market

![]()

Managing Exchange Rates

![]()

Foreign Exchange Rates

![]()

3.Corporate Issuers(双语字幕)

Features of Corporate Issuers

![]()

Stakeholders and ESG Factors

![]()

Corporate Governance

![]()

Liquidity Measures and Management

![]()

Capital Investments and Project Measures

![]()

Capital Allocation Principles and Real Options

![]()

Weighted-Average Cost of Capital

![]()

Capital Structure Theories

![]()

Business Model Features and Types

![]()

4.Financial Statement Analysts(双语字幕)

Financial Statement Roles

![]()

Revenue Recognition

![]()

Expense Recognition

![]()

Nonrecurring Items

![]()

Earnings Per Share

![]()

Ratios and Common-Size Income Statements

![]()

Intangible Assets and Marketable Securities

![]()

Common-Size Balance Sheets

![]()

Cash Flow Introduction and Direct Method CFO

![]()

Indirect Method CFO

![]()

Investing and Financing Cash Flows and IFRSU.S. GAAP Differences

![]()

Analyzing Statements of Cash Flows II

![]()

Inventory Measurement

![]()

Inflation Impact on FIFO and LIFO

![]()

Presentation and Disclosure

![]()

Intangible Long-Lived Assets

![]()

Impairment and Derecognition

![]()

Long-Term Asset Disclosures

![]()

Leases

![]()

Deferred Compensation and Disclosures

![]()

Differences Between Accounting Profit and Taxable Income

![]()

Deferred Tax Assets and Liabilities

![]()

Tax Rates and Disclosures

![]()

Reporting Quality

![]()

Accounting Choices and Estimates

![]()

Introduction to Financial Ratio

![]()

Financial Ratios Part 1

![]()

Financial Ratios Part 2

![]()

DuPont Analysis

![]()

Industry-Specific Financial Ratios

![]()

Financial Statement Modeling

![]()

5.Equity Investments(双语字幕)

Markets Assets and Intermediaries

![]()

Positions and Leverage

![]()

Order Execution and Validity

![]()

Index Weighting Methods

![]()

Uses and Types of Indexes

![]()

Market Efficiency

![]()

Types of Equity Investments

![]()

Foreign Equities and Equity Risk

![]()

Company Research Reports

![]()

Revenue, Profitability, and Capital

![]()

Industry Analysis

![]()

Industry Structure and Competitive Positioning

![]()

Forecasting in Company Analysis

![]()

Dividends, Splits, and Repurchases

![]()

Dividend Discount Models

![]()

Relative Valuation Measures

![]()

6.Fixed Income(双语字幕)

Fixed-Income Instrument Features

![]()

Fixed-Income Cash Flows and Types

![]()

Fixed-Income Issuance and Trading

![]()

Fixed-Income Markets for Corporate Issuers

![]()

Fixed-Income Markets for Government Issuers

![]()

Fixed-Income Bond Valuation- Prices and Yields

![]()

Yield and Yield Spread Measures for Fixed-Rate Bonds

![]()

Yield and Yield Spread Measures for Floating-Rate Instruments

![]()

The Term Structure of Interest Rates- Spot, Par, and Forward Curves

![]()

Interest Rate Risk and Return

![]()

Yield-Based Bond Duration Measures and Properties

![]()

Yield-Based Bond Convexity and Portfolio Propertie

![]()

Curve-Based and Empirical Fixed-Income Risk Measures

![]()

Credit Risk

![]()

Credit Analysis for Government Issuers

![]()

Credit Analysis for Corporate Issuers

![]()

Fixed-Income Securitization

![]()

Asset-Backed Security (ABS) Instrument and Market Features

![]()

Mortgage-Backed Security (MBS) Instrument and Market Features

![]()

7.Derivatives(双语字幕)

Derivatives Markets

![]()

Forwards and Futures

![]()

Swaps and Options

![]()

Uses, Benefits, and Risks of Derivatives

![]()

Arbitrage, Replication, and Carrying Costs

![]()

Forward Contract Valuation

![]()

Futures Valuation

![]()

Swap Valuation

![]()

Option Valuation

![]()

Put-Call Parity

![]()

Binomial Model for Option Values

![]()

8.Alternative Investments(双语字幕)

Alternative Investment Structures

![]()

Performance Appraisal and Return Calculations

![]()

Private Capital

![]()

Real Estate

![]()

Infrastructure

![]()

Farmland, Timberland, and Commodities

![]()

Hedge Funds

![]()

Distributed Ledger Technology

![]()

Digital Asset Characteristics

![]()

9.Portfolio Management and Wealth Planning(双语字幕)

Historical Risk and Return

![]()

Risk Aversion

![]()

Portfolio Standard Deviation

![]()

The Efficient Frontier

![]()

Systematic Risk and Beta

![]()

The CAPM and the SML

![]()

Portfolio Management Process

![]()

Asset Management and Pooled Investments

![]()

Portfolio Planning and Construction

![]()

Cognitive Errors vs. Emotional Biases

![]()

Emotional Biases

![]()

Introduction to Risk Management

![]()

10.Ethical and Professional Standards(双语字幕)

Ethics and Trust

![]()

Code and Standards

![]()

Guidance for Standards I(A) and I(B)

![]()

Guidance for Standards I(C), I(D), and I(E)

![]()

Guidance for Standard II

![]()

Guidance for Standards III(A) and III(B)

![]()

Guidance for Standards III(C), III(D), and III(E)

![]()

Guidance for Standard IV

![]()

Guidance for Standard V

![]()

Guidance for Standard VI

![]()

Guidance for Standard VII

![]()

Introduction to GIPS

![]()

Ethics Application

![]()

1.Quantitative Methods

1.1-Interest Rates and Return Measurement

![]()

1.2-Time-Weighted and Money-Weighted Returns

![]()

1.3-Common Measures of Return

![]()

2.1-Discounted Cash Flow Valuation_2

![]()

3.1-Central Tendency and Dispersion

![]()

3.2-Skewness Kurtosis and Correlation

![]()

4.1-Probability Models Expected Values and Bayes Formula

![]()

5.1-Probability Models for Portfolio Return and Risk

![]()

6.1-Lognormal Distributions and Simulation Techniques

![]()

7.1-Sampling Techniques and the Central Limit Theorem

![]()

8.1-Hypothesis Testing Basics

![]()

8.2-Types of Hypothesis Tests

![]()

9.1-Tests for Independence

![]()

10.1-Linear Regression Basics

![]()

10.2-Analysis of Variance ANOVA and Goodness of Fit

![]()

10.3-Predicted Values and Functional Forms of Regression

![]()

11.1-Introduction to Fintech

![]()

2.Economics

12.1- Breakeven, Shutdown, and Scale

![]()

12.2- Characteristics of Market Structures

![]()

12.3- Identifying Market Structures

![]()

13.1- Business Cycles

![]()

14.1- Fiscal Policy Objectives

![]()

14.2- Fiscal Policy Tools and Implementation

![]()

15.1- Central Bank Objectives and Tools

![]()

15.2- Monetary Policy Effects and Limitations

![]()

16.1- Geopolitics

![]()

17.1- International Trade

![]()

18.1- The Foreign Exchange Market

![]()

18.2- Managing Exchange Rates

![]()

19.1- Foreign Exchange Rates

![]()

3.Corporate Issuers

20.1-Features of Corporate Issuers

![]()

21.1-Stakeholders and ESG Factors

![]()

22.1-Corporate Governance

![]()

23.1-Liquidity Measures and Management

![]()

24.1-Capital Investments and Project Measures

![]()

24.2-Capital Allocation Principles and Real Options

![]()

25.1-Weighted-Average Cost of Capital

![]()

25.2-Capital Structure Theories

![]()

26.1-Business Model Features and Types

![]()

4.Financial Statement Analysts

27.1-Financial Statement Roles

![]()

28.1-Revenue Recognition

![]()

28.2-Expense Recognition

![]()

28.3-Nonrecurring Items

![]()

28.4-Earnings Per Share

![]()

28.5-Ratios and Common-Size Income Statements

![]()

29.1-Intangible Assets and Marketable Securities

![]()

29.2-Common-Size Balance Sheets

![]()

30.1-Cash Flow Introduction and Direct Method CFO

![]()

30.2-Indirect Method CFO

![]()

30.3-Investing and Financing Cash Flows and IFRSU.S. GAAP Differences

![]()

31.1-Analyzing Statements of Cash Flows II

![]()

32.1-Inventory Measurement

![]()

32.2-Inflation Impact on FIFO and LIFO

![]()

32.3-Presentation and Disclosure

![]()

33.1-Intangible Long-Lived Assets

![]()

33.2-Impairment and Derecognition

![]()

33.3-Long-Term Asset Disclosures

![]()

34.1-Leases

![]()

34.2-Deferred Compensation and Disclosures

![]()

35.1-Differences Between Accounting Profit and Taxable Income

![]()

35.2-Deferred Tax Assets and Liabilities

![]()

35.3-Tax Rates and Disclosures

![]()

36.1-Reporting Quality

![]()

36.2-Accounting Choices and Estimates

![]()

36.3-Warning Signs

![]()

37.1-Introduction to Financial Ratios

![]()

37.2-Financial Ratios Part 1

![]()

37.3-Financial Ratios Part 2

![]()

37.4-DuPont Analysis

![]()

37.5-Industry-Specific Financial Ratios

![]()

38.1-Financial Statement Modeling

![]()

5.Equity Investments

39.1-Markets Assets and Intermediaries

![]()

39.2-Positions and Leverage

![]()

39.3-Order Execution and Validity

![]()

40.1-Index Weighting Methods

![]()

40.2-Uses and Types of Indexes

![]()

41.1-Market Efficiency

![]()

42.1-Types of Equity Investments

![]()

42.2-Foreign Equities and Equity Risk

![]()

43.1-Company Research Reports

![]()

43.2-Revenue, Profitability, and Capital

![]()

44.1-Industry Analysis

![]()

44.2-Industry Structure and Competitive Positioning

![]()

45.1-Forecasting in Company Analysis

![]()

46.1-Dividends, Splits, and Repurchases

![]()

46.2-Dividend Discount Models

![]()

46.3-Relative Valuation Measures

![]()

47.1- Fixed-Income Instrument Features

![]()

48.1- Fixed-Income Cash Flows and Types

![]()

49.1- Fixed-Income Issuance and Trading

![]()

6.Fixed Income

50.1- Fixed-Income Markets for Corporate Issuers

![]()

51.1- Fixed-Income Markets for Government Issuers

![]()

52.1- Fixed-Income Bond Valuation- Prices and Yields

![]()

53.1- Yield and Yield Spread Measures for Fixed-Rate Bonds

![]()

54.1- Yield and Yield Spread Measures for Floating-Rate Instruments

![]()

55.1- The Term Structure of Interest Rates- Spot, Par, and Forward Curves

![]()

56.1- Interest Rate Risk and Return

![]()

57.1- Yield-Based Bond Duration Measures and Properties

![]()

58.1- Yield-Based Bond Convexity and Portfolio Properties

![]()

59.1- Curve-Based and Empirical Fixed-Income Risk Measures

![]()

60.1- Credit Risk

![]()

61.1- Credit Analysis for Government Issuers

![]()

62.1- Credit Analysis for Corporate Issuers

![]()

63.1- Fixed-Income Securitization

![]()

64.1- Asset-Backed Security (ABS) Instrument and Market Features

![]()

65.1- Mortgage-Backed Security (MBS) Instrument and Market Features

![]()

7.Derivatives

66.1-Derivatives Markets

![]()

67.1-Forwards and Futures

![]()

67.2-Swaps and Options

![]()

68.1-Uses, Benefits, and Risks of Derivatives

![]()

69.1-Arbitrage, Replication, and Carrying Costs

![]()

70.1-Forward Contract Valuation

![]()

71.1-Futures Valuation

![]()

72.1-Swap Valuation

![]()

73.1-Option Valuation

![]()

74.1-Put-Call Parity

![]()

75.1-Binomial Model for Option Values

![]()

8.Alternative Investments

76.1-Alternative Investment Structures

![]()

77.1-Performance Appraisal and Return Calculations

![]()

78.1-Private Capital

![]()

79.1-Real Estate

![]()

79.2-Infrastructure

![]()

80.1-Farmland, Timberland, and Commodities

![]()

81.1-Hedge Funds

![]()

82.1-Distributed Ledger Technology

![]()

82.2-Digital Asset Characteristics

![]()

9.Portfolio Management and Wealth Planning

83.1-Historical Risk and Return

![]()

83.2-Risk Aversion

![]()

83.3-Portfolio Standard Deviation

![]()

83.4-The Efficient Frontier

![]()

84.1-Systematic Risk and Beta

![]()

84.2-The CAPM and the SML

![]()

85.1-Portfolio Management Process

![]()

85.2-Asset Management and Pooled Investments

![]()

86.1-Portfolio Planning and Construction

![]()

87.1-Cognitive Errors vs. Emotional Biases

![]()

87.2-Emotional Biases

![]()

88.1-Introduction to Risk Management

![]()

10.Ethical and Professional Standards

89.1-Ethics and Trust

![]()

90.1-Code and Standards

![]()

91.1-Guidance for Standards I(A) and I(B)

![]()

91.2-Guidance for Standards I(C), I(D), and I(E)

![]()

91.3-Guidance for Standard II

![]()

91.4-Guidance for Standards III(A) and III(B)

![]()

91.5-Guidance for Standards III(C), III(D), and III(E)

![]()

91.6-Guidance for Standard IV

![]()

91.7-Guidance for Standard V

![]()

91.8-Guidance for Standard VI

![]()

91.9-Guidance for Standard VII

![]()

92.1-Introduction to GIPS

![]()

93.1-Ethics Application

![]()