ACCA TX题目分享Value added tax,Corporation tax liabilities

第一道题:PART F Value added tax(X)

For the quarter ended 31 March 2023, what is the amount of non-deductible input VAT in respect of entertaining UK customers and the leasing cost of the car?

第一道题:PART E Corporation tax liabilities(X)

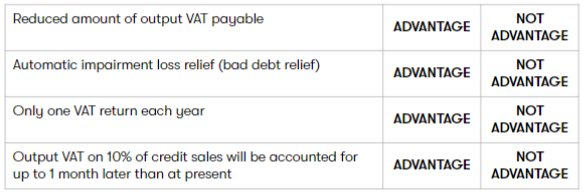

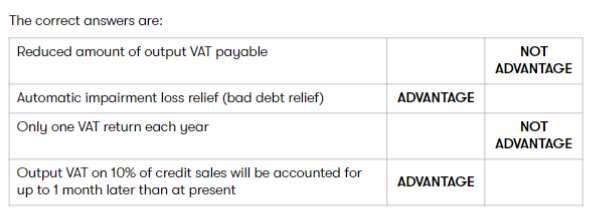

ldentify, by clicking on the relevant boxes in the table below, whether each of the following statements are the advantages of Anne using the cash accounting scheme.

解析:

B Option 2

The output VAT payable will remain the same and accounting for VAT will also remain the same.

C Option 3

D Option 4

答案:C

The correct answer is: Option 3

The input tax of £800×20%=£160 on entertaining UK customers is non-deductible (but would be deductible for entertaining overseas customers). The answer £0 permits deductionof input tax on entertaining UK customers.

50% of the input tax is deductible on leased cars where there is some private use so the remaining 50%×£700×20%=£70 is non-deductible. The answer £105 is 75%×£700×20%=£105(ie based on the amount of private use).

A Option 1