ACCA FA智课两道题分享petty cash,The year end inventory

第一道题:

Which of the following statements about petty cash is/are true?

(1)Under the imprest system petty cash is topped up by a fixed amount each period

(2)A record of petty cash transactions should be maintained to help prevent funds being abused for personal expenses

(3)Petty cash does not form part of a company's cash balance in the final accounts

A 1,3

B 1,2

C 2

D 3

答案:C

解析:

2 only

Petty cash is the name for the small cash float most businesses hold on their premises to make occasional small payments in cash. Petty cash is therefore part of a company's cash balance and will appear in the final accounts as part of the overall 'cash at bank and in hand' balance.

Under the imprest system the petty cash is kept at an agreed sum so that each topping up is equal to the amount paid out in the period, and is therefore not a fixed amount.

第二道题:

The year end inventory had been recorded as $850,000. However, the following information has now been found:

(1)300 items which were included at cost of $2 per item are now found to be worth $2.40 per item.

(2)500 items which were included at cost of $4 per item are found to be in need of modification before being sold. The expected selling price is $4.60 per item, if modification costs of $0.80 are incurred.

(3)100 items which were included at total cost of $400 were destroyed after the year end in a fire in part of the warehouse.

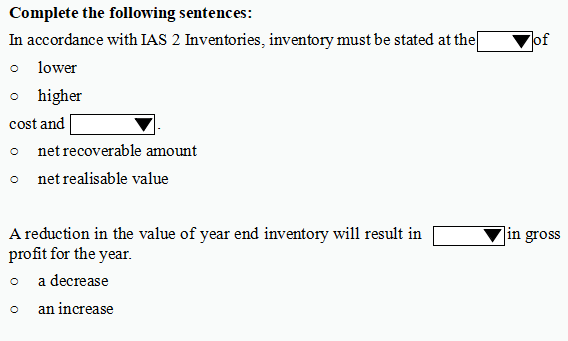

解析:

lower

Net realisable value

a decrease(Year end inventory is deducted from cost of sales.)

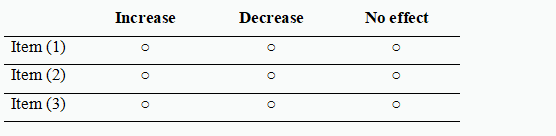

(1)The discovery that the items are worth $2.40 per item hasno effect on inventory valuation as this is higher than cost of $2.

(2)The items are currently held at cost of $4 per item. Net realisable value is $3.80 ($4.60 - $0.80). As this is lower than cost the 500 items should be valued at $3.80 each. This willdecrease the inventory valuation.

(3)The fire took place after the year end therefore it hasno effect on the value of the inventory at the year end date. It is a non-adjusting event after the reporting period.