ACCA-FA智课题目分享financial statements,FA (Financial Accounting)。

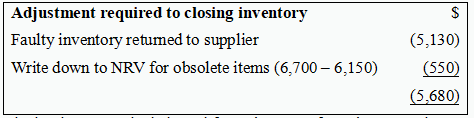

On 31 May 20X0, Charmaine Co counted it's closing inventory for the year ended 31 May 20X0. Its valuation at cost amounted to $459,204. Several days later, the company realised that it had included inventory of $5,130 which had been identified as faulty during the inventory count and has been returned to the supplier. Additionally, certain inventory items with a cost of $6,700 were obsolete and only had a net realisable value of $6,150.

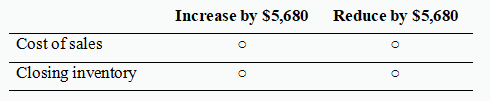

What should the adjustments be to cost of sales and closing inventory in the financial statements for the year ended 31 May 20X0?

解析:

Cost of sales Increase by $5,680

Closing inventory Reduce by $5,680

Closing inventory is deducted from the cost of purchases to give cost of sales. So a decrease in closing inventory gives a higher cost of sales value.